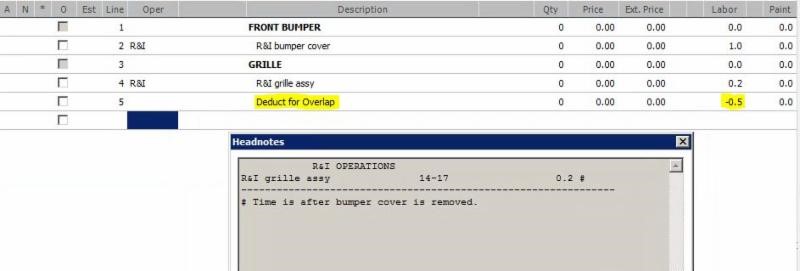

Recent Inquiry 12871 discovered that when grille R/I is being performed on bumper cover R/I or R/R labor, Deduct for Overlap is still being applied to the R/I grille labor when the time has already been adjusted to the R/I labor value based on the H Notes section.

Below is the response from CCC:

“It appears the attempt to allow the difference of labor time between R&R and R&I Grille is not working properly when the R&R Grille is selected with the R&R Bumper, and the bumper includes only the R&I grille per the footnote. This is causing a negative impact that was not identified initially.

CCC does not currently have the ability to support the R&I portion of labor time being deducted from the R&R Grille time when selected with the R&R or O/H Bumper.

The overlap deduction currently in place will need to be removed, and this concern will be added to the backlog for further review when time permits.”

This example below shows a 2016 Honda Odyssey overlap being taken on r/I grille which should not apply and manually needs to be corrected.

The estimating databases are all intended to be used as a GUIDE ONLY – it is important to remember that the auto body professional performing the repair is in a position to thoroughly inspect, diagnose and identify the methodology and their unique cost of the vehicle damage repair.

You can view this tip and others on the DEG website by clicking here!

For more information about SCRS, or to join as a member, please visit

www.scrs.com, call toll free 1-877-841-0660 or email us at info@scrs.com.