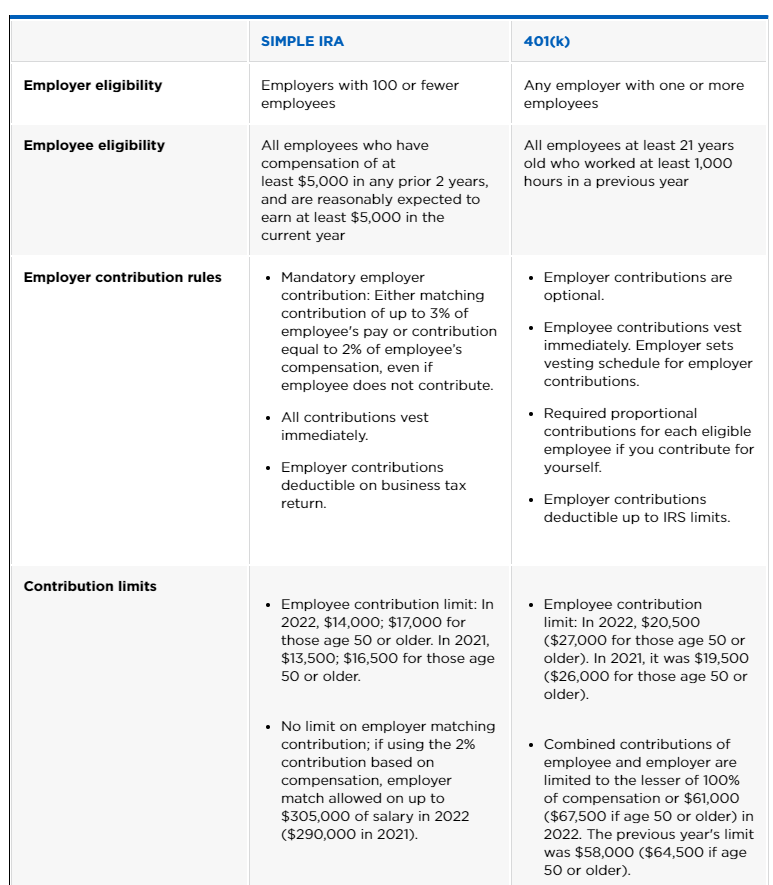

A SIMPLE IRA is a calendar year retirement savings plan – meaning it can’t be changed mid year – and NOW is your best time to explore the advantages a change might make for your business.

If you currently offer a SIMPLE and are debating which type of plan is the best fit for your business and employees. In order to make a change for 2023, certain requirements need to be met by November 1, 2022.

SCRS’ advisors are able to help compare and contrast plan options, and help to explain some of the misconceptions about 401(k) costs and rates that SCRS has worked to address with the association’s Multiple Employer Plan (MEP).

Visit www.scrs.com/401k to contact our advisory team, and fill out a basic request for more information.

About SCRS: Through its direct members and 37 affiliate associations, SCRS is comprised of 6,000 collision repair businesses and 58,500 specialized professionals who work with consumers and insurance companies to repair collision-damaged vehicles. Additional information about SCRS including other news releases is available at the SCRS Web site: www.scrs.com. You can e-mail SCRS at the following address: info@scrs.com.